Top AI tools for Loan Officer

-

Dispute Beast Your Ultimate DIY Financial Health Assistant Tool

Dispute Beast Your Ultimate DIY Financial Health Assistant ToolDispute Beast is an AI-powered financial software that helps users improve their finances. It offers a free dispute letter engine, requiring only an active Beast Monitoring subscription.

- Paid

- From 50$

-

ADEPT Decisions Platform The Fintech Lending Toolkit for Optimized Credit Decisions

ADEPT Decisions Platform The Fintech Lending Toolkit for Optimized Credit DecisionsThe ADEPT Decisions Platform is a no-code, cloud-native decision engine leveraging Machine Learning to automate and optimize lending decisions for financial institutions.

- Contact for Pricing

-

Mortguage.app Fast, Simple Mortgage Payment Calculator

Mortguage.app Fast, Simple Mortgage Payment CalculatorMortguage.app provides instant mortgage payment estimates, helping users budget and plan for home loans with ease and confidence.

- Free

-

Validit.ai Your #1 Defense Against Fraud

Validit.ai Your #1 Defense Against FraudValidit.ai is an AI-based fraud prevention service that assesses human intent using behavioral science and bio-signal processing to safeguard businesses.

- Contact for Pricing

-

BirchAI Automating Complex Call Center Operations

BirchAI Automating Complex Call Center OperationsBirchAI leverages state-of-the-art AI to automate after-call work in healthcare, insurance, and banking, reducing Average Handle Time by up to 35%.

- Contact for Pricing

-

Smart Solution Accelerate Financial Evolution Through Core Banking Innovation

Smart Solution Accelerate Financial Evolution Through Core Banking InnovationSmart Solution delivers advanced banking infrastructure, empowering financial institutions with scalable, technology-focused platforms for growth, compliance, and exceptional customer service.

- Contact for Pricing

-

Vaultedge Transform documents into actionable data with Document AI suite

Vaultedge Transform documents into actionable data with Document AI suiteVaultedge provides a Document AI suite utilizing AI OCR and lending APIs to automate document recognition, data extraction, validation, and compliance checks, reducing manual work and accelerating approvals.

- Contact for Pricing

-

Ntropy Insights Save 80% on underwriting a business using AI and bank data.

Ntropy Insights Save 80% on underwriting a business using AI and bank data.Ntropy Insights utilizes AI with bank data to automatically generate Profit & Loss (P&L) and cash statements in milliseconds, significantly accelerating the business underwriting process.

- Contact for Pricing

-

Credit Time 2000 Metro 2® Credit Reporting Software for Comprehensive Bureau Compliance

Credit Time 2000 Metro 2® Credit Reporting Software for Comprehensive Bureau ComplianceCredit Time 2000 simplifies Metro 2® format credit reporting for businesses, enabling secure, error-free submissions to all major national and alternative credit bureaus.

- Paid

- From 50$

-

Glia Unified Interaction Management for Financial Services

Glia Unified Interaction Management for Financial ServicesGlia offers a Unified Interaction Management platform designed for financial institutions. It helps businesses improve customer experiences, increase sales, and enhance operational efficiency through AI-powered communication tools.

- Contact for Pricing

-

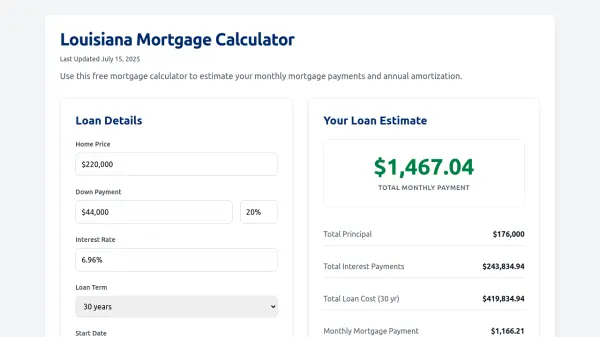

Louisiana Mortgage Calculator Free Mortgage Estimator for Louisiana Homebuyers

Louisiana Mortgage Calculator Free Mortgage Estimator for Louisiana HomebuyersLouisiana Mortgage Calculator is a free online tool designed to help users estimate monthly mortgage payments, total loan costs, and amortization schedules for home purchases in Louisiana.

- Free

-

AviaryAI AI Outbound Voice Agents and Knowledge Base for Financial Institutions

AviaryAI AI Outbound Voice Agents and Knowledge Base for Financial InstitutionsAviaryAI offers AI-powered outbound voice agents and a knowledge base tailored for credit unions, banks, and insurance providers to enhance customer engagement and streamline operations.

- Contact for Pricing

-

MyLoans.ai Free AI Guidance for Complex Student Loans

MyLoans.ai Free AI Guidance for Complex Student LoansMyLoans.ai is an AI-powered platform that provides instant, personalized student loan guidance to help borrowers navigate complex loan decisions and potentially save thousands in repayments.

- Free

-

Mortgage+Care Comprehensive Loan Servicing and Origination Management

Mortgage+Care Comprehensive Loan Servicing and Origination ManagementMortgage+Care delivers affordable loan servicing software featuring origination, escrow, investor portals, trust accounting, integrated collections, and comprehensive reporting capabilities.

- Contact for Pricing

-

Casca Process 10x more loans with an AI Assistant

Casca Process 10x more loans with an AI AssistantCasca is an AI-native Loan Origination System that helps FDIC-insured banks and non-bank lenders automate 90% of manual effort in business loan origination, featuring 24/7 AI loan assistance and intelligent document processing.

- Contact for Pricing

-

Flowtrics The Leader in AI Data, Task, Contract & Document Workflow Automation

Flowtrics The Leader in AI Data, Task, Contract & Document Workflow AutomationFlowtrics is an AI-powered platform designed to automate data, tasks, contracts, and document workflows, enhancing business process efficiency.

- Contact for Pricing

-

StubCheck.com Generate Professional Paystubs Instantly and Accurately

StubCheck.com Generate Professional Paystubs Instantly and AccuratelyStubCheck.com offers an online paystub generator with intelligent algorithms to create professional, state-compliant paystubs in minutes, simplifying payroll for businesses, employees, and contractors.

- Freemium

-

Zest AI Proven AI for a Thriving Lending Ecosystem

Zest AI Proven AI for a Thriving Lending EcosystemZest AI provides AI-powered solutions for lenders, improving underwriting accuracy, automating decisions, and reducing risk. The platform helps financial institutions make smarter, fairer, and faster lending decisions.

- Contact for Pricing

-

Surefire CRM by Top of Mind Networks Automated Mortgage Marketing and CRM for Lenders

Surefire CRM by Top of Mind Networks Automated Mortgage Marketing and CRM for LendersSurefire CRM delivers automated, compliance-ready marketing and customer relationship management tailored to the mortgage industry, helping lenders nurture leads, manage pipelines, and engage clients through omni-channel campaigns.

- Contact for Pricing

-

BankGPT AI Assistant for Statements, Invoices & Receipts

BankGPT AI Assistant for Statements, Invoices & ReceiptsBankGPT is an AI platform that automates financial document processing, extracting and analyzing data from bank statements, invoices, and receipts for banks and enterprises.

- Freemium

-

AI Credit Repair AI-powered credit repair solution for identifying and removing credit report errors

AI Credit Repair AI-powered credit repair solution for identifying and removing credit report errorsAI Credit Repair is an advanced credit management platform that uses artificial intelligence to help users monitor, repair, and protect their credit through automated dispute resolution and personalized improvement strategies.

- Pay Once

-

Pagaya AI-powered credit analysis for smarter lending decisions

Pagaya AI-powered credit analysis for smarter lending decisionsPagaya is an AI-powered financial technology platform that helps lending institutions analyze credit applications and make better lending decisions without increasing risk.

- Contact for Pricing

-

Arya AI Production-Ready AI for Finance

Arya AI Production-Ready AI for FinanceArya AI provides pre-built, finance-specific AI models and APIs to help banks, insurance companies, and financial institutions streamline operations, enhance security, and improve decision-making.

- Contact for Pricing

-

MobiFin Unified Digital Banking and Payments Platform

MobiFin Unified Digital Banking and Payments PlatformMobiFin is a comprehensive digital banking and fintech platform designed to deliver seamless financial services, including digital wallets, core banking, loan management, and agency banking, empowering banks and fintechs with secure, integrated solutions.

- Contact for Pricing

-

Senso AI-Powered Agents For Financial Services

Senso AI-Powered Agents For Financial ServicesSenso provides AI agents designed to improve operational efficiency and staff productivity for financial institutions. Transform unstructured policies into structured knowledge for streamlined operations.

- Contact for Pricing

-

Floatbot Elevating Customer, Agent, and Employee Experience with Conversational AI Agents + Copilot

Floatbot Elevating Customer, Agent, and Employee Experience with Conversational AI Agents + CopilotFloatbot is a GenAI-powered platform offering Voice and Chat AI Agents, along with real-time agent assist, to automate customer interactions and improve efficiency across industries.

- Freemium

- From 99$

-

Hapax Purpose Built AI Customized for your Bank or Credit Union

Hapax Purpose Built AI Customized for your Bank or Credit UnionHapax is an AI partner built to evolve, unifying intelligence and adapting to your needs to drive smarter decisions for banks and credit unions. It turns knowledge into actionable insights, transforming data into impact.

- Contact for Pricing

-

Feathery End-to-End AI-Powered Data Intake Workflows

Feathery End-to-End AI-Powered Data Intake WorkflowsFeathery provides an AI-driven platform for building advanced forms and automating data intake workflows, specializing in regulated industries like insurance, finance, and healthcare.

- Freemium

- From 49$

-

TartanHQ Redefining Enterprise Solutions with Unified APIs and Agentic Apps

TartanHQ Redefining Enterprise Solutions with Unified APIs and Agentic AppsTartanHQ offers unified APIs and agentic AI applications designed to streamline enterprise operations across various industries like lending, insurance, banking, and HR tech.

- Contact for Pricing

-

Synapse Analytics Revolutionize Credit Decisioning with AI-Powered Precision.

Synapse Analytics Revolutionize Credit Decisioning with AI-Powered Precision.Synapse Analytics is an AI credit decisioning platform designed to increase loan approvals, reduce risk, and streamline operations for financial institutions.

- Contact for Pricing

-

Layerup Human-like voice AI for financial institutions

Layerup Human-like voice AI for financial institutionsLayerup provides AI-powered voice agents for financial institutions, handling collections, payment reminders, and loan servicing with human-like interactions across multiple communication channels. The platform enhances engagement rates by up to 70% and response rates by up to 90%.

- Contact for Pricing

-

Ocrolus AI-driven document processing automation with Human-in-the-Loop

Ocrolus AI-driven document processing automation with Human-in-the-LoopOcrolus is an intelligent document processing platform that helps lenders automate financial document analysis, detect fraud, and make faster, more accurate lending decisions.

- Freemium

-

Orin Fintech AI Agent Store

Orin Fintech AI Agent StoreOrin provides a Fintech AI Agent Store with pre-trained AI agents for customer support, deployable in three steps. It offers a modern customer support platform specifically designed for Fintech companies.

- Paid

-

KlearStack Eliminate Manual Document Processing Using AI

KlearStack Eliminate Manual Document Processing Using AIKlearStack is an AI-powered platform designed to automate document processing, enabling fast and accurate data extraction and compliance auditing for businesses.

- Paid

- From 300$

-

Salient AI loan servicing platform built specifically for automotive finance

Salient AI loan servicing platform built specifically for automotive financeSalient is an AI-powered loan servicing platform specifically designed for the automotive finance industry. It streamlines operations like loan onboarding, collections, and compliance using AI agents.

- Contact for Pricing

-

BeetleLabs.ai Smart AI Agents For BFSI

BeetleLabs.ai Smart AI Agents For BFSIBeetleLabs.ai offers AI-powered agents to revolutionize customer support and engagement within the BFSI sector, enhancing efficiency and automation.

- Free Trial

-

Zirtue The Smart Way To Manage Relationship-Based Loans

Zirtue The Smart Way To Manage Relationship-Based LoansZirtue is a secure digital platform that helps users borrow, lend, and repay money with friends and family, eliminating paper IOUs and adding transparency to personal loans.

- Free

-

RiskSeal Smart decisions through digital footprints

RiskSeal Smart decisions through digital footprintsRiskSeal is a global platform for alternative credit risk data that provides 400+ instant data points and digital credit scoring through analysis of digital footprints across 200+ online platforms.

- Usage Based

- From 499$

-

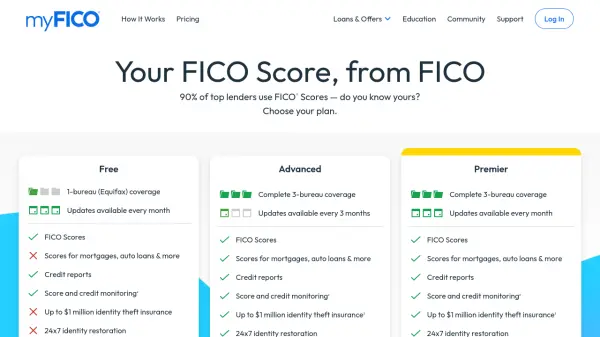

myFICO Monitor Your Credit and Access Official FICO Scores

myFICO Monitor Your Credit and Access Official FICO ScoresmyFICO enables users to view their official FICO credit scores, monitor credit reports across multiple bureaus, and receive identity theft protection, supporting smarter financial decisions.

- Freemium

- From 20$

-

FoxyAI Visual Property Intelligence

FoxyAI Visual Property IntelligenceFoxyAI offers AI-powered visual property intelligence solutions for the real estate industry. It uses computer vision to analyze property images and provide accurate valuations, condition assessments, and quality control.

- Contact for Pricing

-

FISCAL Streamline Credit Analysis and Loan Management for Community Banks and Credit Unions

FISCAL Streamline Credit Analysis and Loan Management for Community Banks and Credit UnionsFISCAL provides comprehensive credit analysis and loan management software tailored for community banks and credit unions, streamlining financial statement spreading and exception tracking with efficiency and accuracy.

- Contact for Pricing

-

Chart Instant Access to Verified Tax Records

Chart Instant Access to Verified Tax RecordsChart provides instant access to verified client tax records directly from the IRS and tax preparation software, automating income verification and client onboarding for fintech companies.

- Contact for Pricing

-

SmartDispute.ai Repair your own credit using the power of artificial intelligence

SmartDispute.ai Repair your own credit using the power of artificial intelligenceSmartDispute.ai is an AI-powered credit repair system that helps users identify and remove negative accounts affecting their credit score through automated dispute generation and tracking across all three credit bureaus.

- Paid

- From 49$

-

ProcessorIQ Transform and Organize Loan Documents Instantly with AI

ProcessorIQ Transform and Organize Loan Documents Instantly with AIProcessorIQ is an AI-powered platform that converts, labels, and risk-checks mortgage files, streamlining document management for mortgage professionals. Experience faster, smarter, and more organized loan cycles with automated PDF conversion and intelligent alerts.

- Freemium

- From 25$

-

Boss Insights Business Data As A Service bridging data gaps between banks and business customers.

Boss Insights Business Data As A Service bridging data gaps between banks and business customers.Boss Insights provides a Business Data as a Service platform, offering real-time access to standardized business data via a single API for financial institutions and fintechs to enhance decision-making and customer engagement.

- Contact for Pricing

-

Optalitix Futureproof your pricing

Optalitix Futureproof your pricingOptalitix provides collaborative, no-code software for actuaries, underwriters, and executives to futureproof pricing, supercharge insurance underwriting, and revolutionize lending processes.

- Contact for Pricing

-

Floify Mortgage Automation Platform for Lenders & Brokers

Floify Mortgage Automation Platform for Lenders & BrokersFloify is a digital mortgage automation platform that streamlines the loan origination process for lenders, brokers, and financial institutions with configurable workflows and advanced borrower experiences.

- Paid

- From 74$

-

Pinakyne AI-Driven Debt Collection for Financial Institutions

Pinakyne AI-Driven Debt Collection for Financial InstitutionsPinakyne leverages advanced AI agents to automate and personalize debt collection for financial institutions, enabling faster recovery rates and reduced operational costs.

- Freemium

- From 4$

-

Heron Automate Your Document-Heavy Work

Heron Automate Your Document-Heavy WorkHeron uses AI to automate document intake, data extraction, enrichment, and synchronization for businesses, streamlining document-heavy workflows.

- Contact for Pricing

-

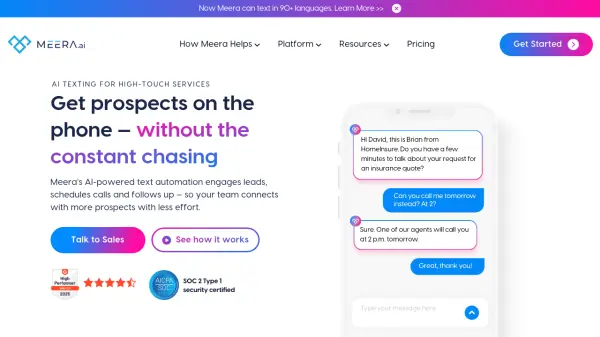

Meera Get prospects on the phone — without the constant chasing

Meera Get prospects on the phone — without the constant chasingMeera is an AI-powered text automation platform designed to help businesses engage leads, schedule calls, and automate follow-ups, increasing connection rates with less effort.

- Contact for Pricing

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.

Didn't find tool you were looking for?