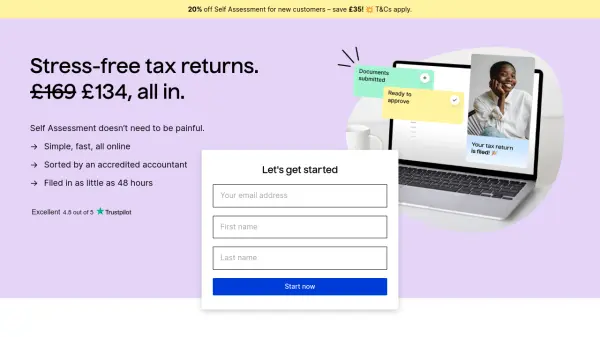

What is TaxScouts?

TaxScouts provides a modern, hassle-free solution to UK tax filing through an entirely online platform. The service leverages automation and AI-driven admin tools to expedite the Self Assessment tax return process, enabling users to answer a few simple questions, get matched with an accredited UK accountant, and have their tax return prepared and filed swiftly. Professional support includes assistance in claiming eligible expenses, minimizing tax liability, and ensuring compliance with HMRC regulations.

Beyond Self Assessment, TaxScouts offers one-off tax advice, a tax bundle, and company return services, all delivered at a fixed transparent fee. The platform’s AI-enhanced bookkeeping tools allow self-employed users to create invoices, track income and expenses, and automatically extract data from receipts. With direct communication channels to accountants and UK-based support, TaxScouts eliminates stress and uncertainty from tax management.

Features

- AI-Powered Admin Automation: Streamlines tax filing by automating routine administrative tasks.

- Accredited Accountant Matching: Pairs clients with UK-based, vetted accountants for professional support.

- Flat Fee Pricing: Transparent, one-off cost regardless of case complexity.

- AI-Enhanced Bookkeeping Tools: Enables automated invoice creation and receipt data extraction for self-employed users.

- Direct Chat Support: Communication with accountants and UK support team through the platform.

- Multi-Service Offering: Provides Self Assessment, company tax returns, one-off tax advice, and tax bundles.

Use Cases

- Filing Self Assessment tax returns for individuals and freelancers.

- Claiming tax reliefs, refunds, and allowances efficiently.

- Managing income, expenses, and invoices for self-employed professionals.

- Obtaining expert advice on UK personal or investment tax scenarios.

- Preparing and submitting company tax returns.

- Quick generation of crypto tax reports for investors.

FAQs

-

What services can TaxScouts help with?

TaxScouts assists with Self Assessment tax returns, one-off tax advice, company tax return filing, and bookkeeping for self-employed individuals. -

How does TaxScouts keep costs low?

The platform automates admin tasks for accountants with AI, passing the resulting cost savings directly to clients via a flat fee. -

Are accountants assigned by TaxScouts accredited?

Yes, all accountants are UK-based, vetted, and possess over five years of industry experience. -

Is support available before and after filing?

Yes, clients can communicate with their assigned accountant and access the UK-based support team at any stage. -

Can TaxScouts help with crypto transactions?

Yes, the service includes a quick and easy crypto tax report for tax purposes.

Related Queries

Helpful for people in the following professions

TaxScouts Uptime Monitor

Average Uptime

98.67%

Average Response Time

535.17 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.