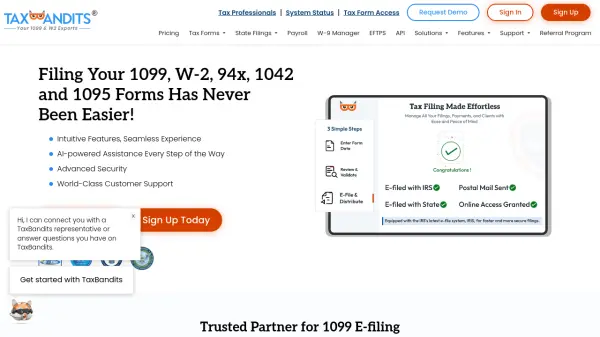

What is TaxBandits?

TaxBandits is a leading cloud-based platform designed to simplify the complex process of filing federal and state tax forms for businesses, tax professionals, and enterprise organizations. By leveraging AI-powered assistance, TaxBandits automates data extraction and validation to enhance accuracy, reduce errors, and expedite the compliance process. Users benefit from a seamless workflow supported by robust features such as bulk data import, document distribution, recipient copy handling, and built-in tax form validations.

The platform supports a wide array of tax forms including 1099, W-2, 94x, ACA, and more, integrating directly with popular accounting software and offering secure online W-9 management. TaxBandits delivers advanced security, comprehensive client and staff management options, instant status updates, and real-time support, making it a reliable compliance partner for businesses of all sizes. Its flexible pay-as-you-file model ensures accessibility without the constraints of recurring subscriptions.

Features

- AI Data Extractor: Streamlines and automates extraction of data from uploaded forms and documents.

- Bulk Data Import: Enables CSV upload and integration with software such as Xero, QuickBooks, Zoho Books, and FreshBooks.

- Automated Data Validation: Built-in IRS business rule validations, TIN matching, and USPS address verification reduce errors.

- Recipient Copy Distribution: Copies delivered via online access, postal mailing (domestic and international), and print options.

- W-9 Manager: Free management of W-9 and W-8BEN forms with AI-powered data extraction, bulk uploads, and validations.

- Compliance & Security: SOC 2, HIPAA, PCI DSS, CCPA compliance; two-factor authentication and advanced cybersecurity.

- Pro Features: Team and client management, customizable portals, detailed reporting, workflow, and user activity tracking.

- Instant Status Updates: Real-time updates on filing status and submission progress.

- API Integration: For developers to automate tax processes and incorporate compliance into their own software.

Use Cases

- Small business owners e-filing annual 1099 or W-2 forms for employees and contractors.

- Accounting firms managing bulk filings and compliance for multiple client organizations.

- Enterprises automating recurring and bulk state/federal tax form submissions.

- Tax professionals distributing recipient copies via multiple channels and managing corrections.

- Developers integrating e-filing functionalities into their own workflow or SaaS products.

- Organizations managing W-9 or W-8BEN requests, collection, and validation for vendors.

FAQs

-

What forms can be e-filed with TaxBandits?

TaxBandits supports the e-filing of a wide variety of forms, including 1099, W-2, 94x (such as 941 and 940), 1042, ACA, 1098, 5498, and more, covering both federal and state filings. -

Does TaxBandits support integrations with accounting software?

Yes, TaxBandits integrates with popular accounting platforms such as Xero, QuickBooks, Zoho Books, and FreshBooks for seamless data import and workflow management. -

Is TaxBandits secure and compliant with industry standards?

TaxBandits employs advanced cybersecurity measures, two-factor authentication, and is compliant with SOC 2, HIPAA, PCI DSS, and CCPA standards to ensure data protection and privacy.

Related Queries

Helpful for people in the following professions

TaxBandits Uptime Monitor

Average Uptime

99.43%

Average Response Time

138.33 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.