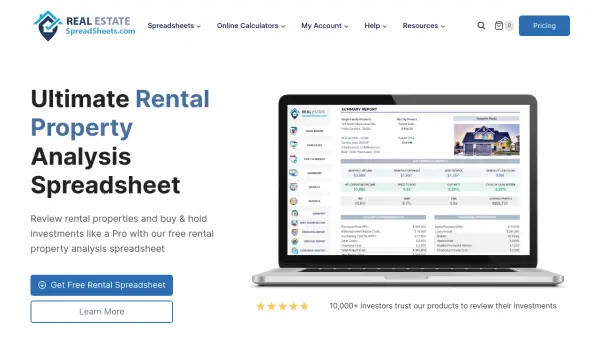

What is Real Estate Spreadsheets?

Real Estate Spreadsheets provides specialized Microsoft Excel templates for real estate investors seeking comprehensive tools to analyze rental properties, house flipping opportunities, and Airbnb investments. These purpose-built spreadsheets deliver advanced financial modeling, including multi-year cash flow forecasts, profitability analysis, debt amortization schedules, and scenario simulations to assist in making sound investment decisions.

The platform focuses on simplicity and customization, catering to both newcomers and seasoned professionals. Features include automated scenario and sensitivity analysis, professional reports for stakeholders, customizable sheets for personalized metrics, and white labeling for business use. With a one-time purchase model, users benefit from premium support and lifelong updates, empowering them to maximize property value and return on investment while minimizing risk.

Features

- Single & Multi-Family Analysis: Review both single-family and large multifamily properties with flexible unit input.

- 30-Year Projections: Generate long-term cash flow, income, expense, and equity build-up forecasts.

- Advanced Profitability Metrics: Calculate IRR, MIRR, Cap Rate, Cash on Cash Return, and other financial indicators.

- Scenario Analysis: Assess how changes in assumptions affect investment profitability automatically.

- Maximum Offering Price Calculation: Compute the highest purchase price based on targeted returns.

- Professional Reports: Print and share summary, financing, and expense reports with stakeholders.

- Visual Graphs: Easy-to-understand charts for cash flow, return, property value, and equity trends.

- Custom Sheet & White Labeling: Modify templates and branding for personalized or business use.

- Debt Amortization Schedule: Break down principal and interest payments over the investment term.

Use Cases

- Evaluating single-family and multifamily rental investment opportunities.

- Comparing buy-and-hold vs. house flipping scenarios.

- Performing sensitivity analysis on real estate deals when adjusting purchase price, rents, or financing terms.

- Generating detailed reports for investors, lenders, or business partners.

- Forecasting long-term profitability and cash flows of property portfolios.

- Optimizing sale dates to maximize total property returns.

- Estimating the maximum purchase offer to meet desired financial objectives.

- Customizing analytical models for specialized or large-scale property analysis.

FAQs

-

What do I need to use the spreadsheet?

You need Microsoft Excel (2013 or newer) on a Windows or Mac computer. The spreadsheet is not compatible with Google Sheets or Apple Numbers. -

Can I customize the spreadsheet to fit my needs?

Yes, the spreadsheet includes a custom sheet that allows you to add features, formulas, and calculations to tailor the analysis to your specific requirements. -

Is the spreadsheet suitable for beginners?

Yes, the spreadsheet is designed to be user-friendly and accessible for users at all experience levels, including those new to Excel or real estate analysis. -

Is there a recurring fee or subscription required?

No, the spreadsheet is offered as a one-time purchase with free updates for life. There are no hidden fees or recurring subscriptions.

Related Queries

Helpful for people in the following professions

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.