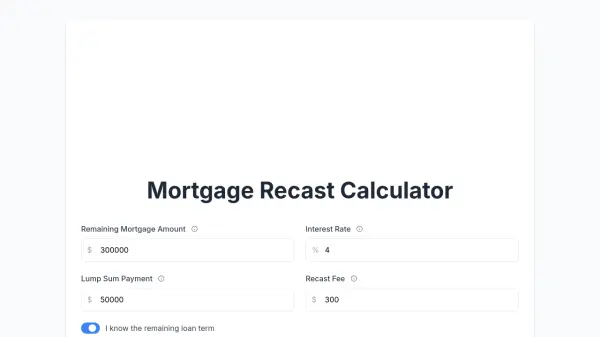

What is Mortgage Recast Calculator?

The Mortgage Recast Calculator is a user-friendly online tool designed for homeowners interested in understanding the financial benefits of mortgage recasting. By entering details such as the remaining mortgage balance, interest rate, lump sum payment, recast fee, and loan term, users can instantly see their new monthly payment amount and potential interest savings without complex manual calculations.

This tool assists users in comparing recasting to other mortgage strategies, highlighting how a lump-sum payment can lower monthly payments while preserving the original rate and term. It clarifies eligibility requirements and walks users through the process, saving time and aiding in informed financial decisions regarding their home loan.

Features

- Instant Calculations: Provides immediate results for new mortgage payments and interest savings.

- Custom Input Fields: Users can input balance, rate, lump-sum payment, recast fees, and loan terms.

- Detailed Results: Shows both original and new payment amounts post-recast.

- Comparison Guidance: Explains differences between recasting, refinancing, and making extra principal payments.

- Eligibility Advice: Outlines requirements for mortgage recasting, including loan type and lender criteria.

Use Cases

- Determining the potential monthly savings after a lump-sum payment to recast a mortgage.

- Comparing the benefits of mortgage recasting versus refinancing.

- Planning for major financial decisions such as applying a bonus or inheritance to a mortgage.

- Understanding qualification criteria and timing for mortgage recasting.

- Estimating one-time fees versus long-term interest and payment reductions.

FAQs

-

What do I need to use the Mortgage Recast Calculator?

You need to provide your remaining mortgage balance, interest rate, lump-sum payment amount, recast fee, and loan term (years and months) to receive accurate results. -

Does the calculator work for all types of mortgages?

The calculator is most relevant for conventional mortgages, as government-backed loans like FHA, VA, and USDA are typically not eligible for recasting. -

Is a credit check required for mortgage recasting?

Generally, your credit score is not a determining factor for recasting eligibility; lenders focus on a good payment history and the lump-sum availability. -

How much does mortgage recasting typically cost?

Most lenders charge a recast fee ranging from $250 to $500, though the amount can vary. -

Can I use the Mortgage Recast Calculator multiple times?

Yes, you can use the tool as many times as you like with different input values to explore various scenarios.

Helpful for people in the following professions

Mortgage Recast Calculator Uptime Monitor

Average Uptime

100%

Average Response Time

444.53 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.