What is Investment Calculator?

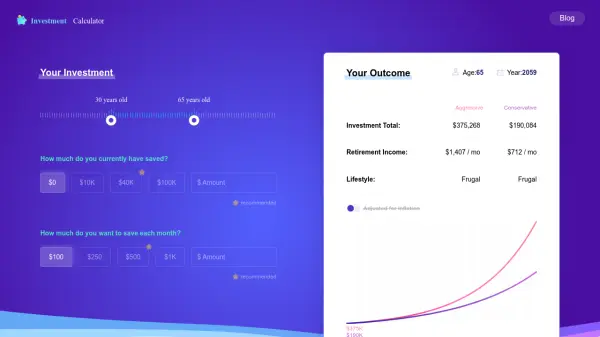

Investment Calculator provides individuals with an interactive platform to estimate and optimize their retirement savings. By simulating both aggressive and conservative investment strategies, the tool enables users to project total savings and potential monthly retirement income. Users can input current savings, desired monthly contributions, and target ages for retirement to model different financial scenarios and compare the impact of lifestyle adjustments, like reducing discretionary spending or increasing investment amounts.

Beyond basic calculations, Investment Calculator incorporates inflation adjustments and allows users to explore personalized recommendations for achieving a comfortable retirement. The tool offers educational resources, practical savings tips, and transparent explanations of its methodology, empowering users to better understand their long-term financial outlook without providing individualized investment advice.

Features

- Dual Strategy Analysis: Compare aggressive and conservative investment projections.

- Personalized Input: Adjust age, savings, and monthly contributions for custom results.

- Inflation Adjustment: Calculates purchasing power over time.

- Lifestyle Scenarios: Models different lifestyle outcomes like frugal or comfortable retirement.

- Savings Tips: Provides actionable advice to increase retirement savings.

- Transparent Methodology: Explains how calculations and recommendations are made.

- Educational Resources: Links to articles and investment guides.

Use Cases

- Planning and optimizing personal retirement savings goals.

- Comparing aggressive versus conservative investment approaches.

- Understanding the financial impact of lifestyle choices on retirement.

- Estimating required monthly contributions for a targeted retirement age.

- Discovering ways to increase long-term savings through behavioral adjustments.

FAQs

-

Does the calculator include Social Security in its estimates?

No, Social Security benefits are not included in the calculator's results as they vary significantly by individual and collection age. -

How are aggressive and conservative investment strategies defined?

Aggressive strategies allocate more towards stocks for higher risk and reward, suitable for longer time horizons, while conservative strategies balance stocks and bonds for lower risk and moderate returns. -

Is the calculator intended to replace a financial advisor?

No, the calculator provides general estimates and insights and does not replace individualized financial advice from a professional. -

How does the calculator adjust for inflation?

The calculator applies an average inflation rate to demonstrate how purchasing power may change over time, offering more realistic retirement projections.

Related Queries

Helpful for people in the following professions

Investment Calculator Uptime Monitor

Average Uptime

99.66%

Average Response Time

172.2 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.