AI for risk professionals in insurance - AI tools

-

Planck PLUS Revolutionizing commercial insurance with GenAI

Planck PLUS Revolutionizing commercial insurance with GenAIPlanck PLUS is an AI-powered platform that provides comprehensive underwriting data and risk assessment solutions for commercial insurance, leveraging generative AI to deliver accurate business classifications and insights.

- Contact for Pricing

-

Insurance AI Ask Any Insurance Question From Your AI Insurance Expert

Insurance AI Ask Any Insurance Question From Your AI Insurance ExpertInsurance AI is an advanced artificial intelligence system designed to provide instant answers and guidance for insurance-related inquiries, from policy coverage to claims processing.

- Free

-

Wrisk Embedded Insurance Platform for the Automotive Industry

Wrisk Embedded Insurance Platform for the Automotive IndustryWrisk provides a digital-first platform enabling automotive brands to create, launch, and manage embedded insurance solutions powered by real-time data and machine learning.

- Contact for Pricing

-

Sixfold Amplifying Confidence In Every Underwriting Decision

Sixfold Amplifying Confidence In Every Underwriting DecisionSixfold is an AI-powered risk assessment platform designed specifically for insurance underwriters, aiming to enhance efficiency, accuracy, and transparency in underwriting decisions.

- Contact for Pricing

-

Inscribe State-of-the-art AI Risk Agents for automated financial risk management

Inscribe State-of-the-art AI Risk Agents for automated financial risk managementInscribe offers AI-powered risk management solutions for financial institutions, featuring AI Risk Agents and Models that automate complex onboarding and underwriting workflows while reducing fraud risks.

- Contact for Pricing

-

AI Insurance The Insurance Platform for New Programs and Captives

AI Insurance The Insurance Platform for New Programs and CaptivesAI Insurance is a comprehensive insurance management platform designed for new programs and captives. It offers AI-powered automation for claims management, financials, and more.

- Free

-

mianalyst.ai Insurance Made Simple With Agentic AI

mianalyst.ai Insurance Made Simple With Agentic AIMiA offers AI-powered agents designed specifically for the insurance industry, streamlining operations and improving decision-making. Enhance efficiency and accelerate growth with MiA's specialized tools.

- Contact for Pricing

-

DocLens Insurance Risk Assistant for Liability Claims and Complex Document Review

DocLens Insurance Risk Assistant for Liability Claims and Complex Document ReviewDocLens is an AI-powered platform that helps insurance professionals analyze liability claims and complex documents with high accuracy, offering automated extraction, evaluation, and risk assessment capabilities.

- Contact for Pricing

-

Shift Technology AI for Insurance Decisions

Shift Technology AI for Insurance DecisionsShift Technology provides AI-driven solutions for the insurance industry, automating and optimizing critical decisions in fraud detection, underwriting, and claims processing.

- Contact for Pricing

-

CAPE Analytics AI-Powered Property Intelligence for Risk

CAPE Analytics AI-Powered Property Intelligence for RiskCAPE Analytics provides AI-powered property intelligence to help insurance carriers, real estate investors, and lenders assess risk and make informed decisions. Its solutions leverage geospatial imagery, computer vision, and machine learning to deliver accurate property insights.

- Contact for Pricing

-

FurtherAI Trusted AI Platform For Underwriting, Claims & Compliance

FurtherAI Trusted AI Platform For Underwriting, Claims & ComplianceFurtherAI provides AI assistants purpose-built for commercial insurance, automating complex workflows and integrating systems to transform underwriting and operations.

- Contact for Pricing

-

OutRiskAI Eliminate Contract Risks with AI Automation

OutRiskAI Eliminate Contract Risks with AI AutomationOutRiskAI is an AI-powered platform designed to help businesses identify and mitigate risks within their contracts automatically. It leverages AI models trained on extensive data to provide accurate risk analysis.

- Paid

- From 29$

-

Convr Commercial Insurance Underwriting On Steroids

Convr Commercial Insurance Underwriting On SteroidsConvr offers an AI-driven underwriting workbench designed to enhance efficiency, profitability, and decision-making for the commercial P&C insurance industry.

- Contact for Pricing

-

Weave.AI Agentic AI-Powered Decision Management

Weave.AI Agentic AI-Powered Decision ManagementWeave.AI is an agentic, GenAI-powered SaaS platform designed for automating risk management, compliance, and due diligence processes across various organizational levels.

- Contact for Pricing

-

Flowiz.AI AI Agents That Work While You Sleep

Flowiz.AI AI Agents That Work While You SleepFlowiz.AI offers a no-code platform to automate tasks and streamline workflows using AI agents. It helps businesses, particularly in insurance, improve efficiency, reduce costs, and enhance customer experience.

- Contact for Pricing

-

Arya AI Production-Ready AI for Finance

Arya AI Production-Ready AI for FinanceArya AI provides pre-built, finance-specific AI models and APIs to help banks, insurance companies, and financial institutions streamline operations, enhance security, and improve decision-making.

- Contact for Pricing

-

Qumis Harness cutting edge AI for your most intricate risks.

Qumis Harness cutting edge AI for your most intricate risks.Qumis is an AI-powered platform for analyzing complex insurance policies. Designed by attorneys, it offers expert-level insights and streamlined workflows for brokers, claim teams, attorneys, and risk professionals.

- Free Trial

-

Resolver Enterprise Risk Intelligence and Resilience Platform

Resolver Enterprise Risk Intelligence and Resilience PlatformResolver offers a robust AI-powered platform that empowers organizations to proactively identify, assess, and manage risks, incidents, and compliance to build enterprise resilience. Its solutions cater to multiple industries, supporting risk mitigation, crisis response, and regulatory compliance through advanced analytics and workflow automation.

- Contact for Pricing

-

Anyrisks Instant Risk Assessments for Any Situation

Anyrisks Instant Risk Assessments for Any SituationAnyrisks is an AI-powered tool that generates comprehensive, industry-specific risk assessments in seconds. It eliminates the need for templates and forms, delivering a fully-formatted report instantly.

- Paid

-

Indico Data Decision Automation Platform for Insurance

Indico Data Decision Automation Platform for InsuranceIndico Data offers an AI-powered platform for the insurance industry, enabling faster, data-driven decisions in underwriting, claims, and policy servicing.

- Contact for Pricing

-

Rafa.ai AI Powered Investing Tool

Rafa.ai AI Powered Investing ToolRafa.ai is an AI-powered investing app designed to assist users in building wealth through data-driven strategies and portfolio management.

- Freemium

- From 29$

- API

-

Riskify AI-Driven Non-Financial Risk Monitoring for Businesses

Riskify AI-Driven Non-Financial Risk Monitoring for BusinessesRiskify utilizes AI to provide real-time monitoring and comprehensive reports on non-financial risks, including capital markets, operational, reputational, cybersecurity, employee, compliance, and ESG risks.

- Freemium

- From 199$

-

Zupervise Unlock transparency, build AI responsibly

Zupervise Unlock transparency, build AI responsiblyZupervise is a unified AI-risk intelligence platform that provides comprehensive monitoring and governance solutions for developers, end-users, and regulators to manage AI-related risks effectively.

- Contact for Pricing

-

Injala Operational Efficiency Unleashed

Injala Operational Efficiency UnleashedInjala provides a comprehensive suite of AI-powered insurance technology solutions designed to streamline risk management and enhance workflow efficiency.

- Contact for Pricing

-

Nuon AI Price Optimisation for Insurers, MGA's and Brokers

Nuon AI Price Optimisation for Insurers, MGA's and BrokersNuon AI delivers growth for personal and commercial lines in the insurance sector. Its proprietary reinforcement learning algorithms optimize pricing in real-time to improve profitability and customer retention.

- Contact for Pricing

-

kalepa.com AI-Powered Underwriting for Commercial & Specialty Insurance

kalepa.com AI-Powered Underwriting for Commercial & Specialty InsuranceCopilot is an AI-powered underwriting platform that helps commercial and specialty insurers bind more profitable risks faster. It streamlines the underwriting process by extracting key insights and managing submissions.

- Contact for Pricing

-

Bryckel The first AI-powered tool for real estate teams to manage complex documents.

Bryckel The first AI-powered tool for real estate teams to manage complex documents.Bryckel is an AI-powered platform designed for real estate teams to automate lease abstraction and document analysis, helping mitigate risks and improve insights.

- Contact for Pricing

-

KYC Hub AI-based Risk Detection and Automation for AML and Fraud

KYC Hub AI-based Risk Detection and Automation for AML and FraudKYC Hub offers an AI-powered platform for comprehensive risk management, AML compliance, and fraud prevention. It provides workflow automation, global screening, and real-time monitoring to streamline compliance processes.

- Contact for Pricing

-

ComplyAdvantage AI-Powered AML and Fraud Risk Detection Platform

ComplyAdvantage AI-Powered AML and Fraud Risk Detection PlatformComplyAdvantage is an AI-driven platform that delivers advanced anti-money laundering (AML) and fraud risk detection solutions for financial institutions and regulated businesses worldwide.

- Contact for Pricing

-

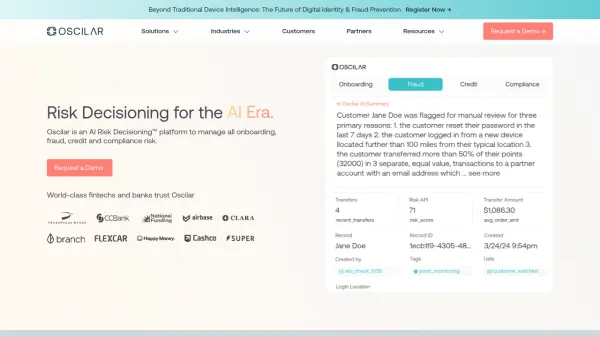

Oscilar Risk Decisioning for the AI Era

Oscilar Risk Decisioning for the AI EraOscilar is an AI Risk Decisioning™ platform designed to manage onboarding, fraud, credit, and compliance risks for financial institutions.

- Contact for Pricing

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.

Explore More

-

online ai video generator 60 tools

-

Conversational AI for e-commerce 46 tools

-

AI for image understanding and generation 43 tools

-

adtech audience engagement platform 22 tools

-

ai email assistant for business 60 tools

-

Next.js AI development 10 tools

-

AI call agent for lead generation 50 tools

-

AI logo generator for startups 42 tools

-

Manual and automatic audio transcription 10 tools

Didn't find tool you were looking for?