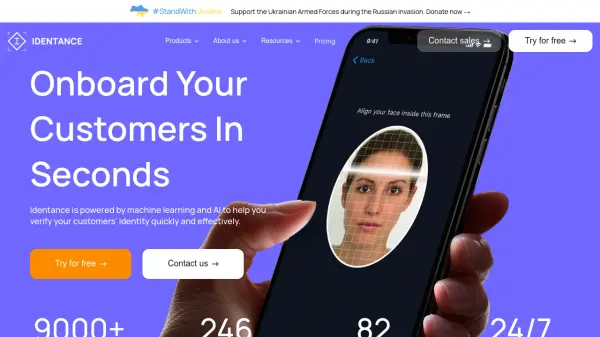

What is KYC Hub?

KYC Hub provides a comprehensive, AI-driven platform designed to streamline financial crime risk management. This cloud-native operating system delivers a frictionless, future-proof technological infrastructure that empowers organizations to efficiently build and deploy risk detection and automation applications.

The platform utilizes advanced technologies, including AI and intelligent automation, to enable workflow orchestration, data aggregation, and rapid no-code development for various risk and compliance use cases. This modular approach allows for seamless onboarding, continuous monitoring, and adaptable risk management across diverse industries and regulatory environments.

Features

- Workflow Automation: Effortlessly create custom workflows and interfaces with no-code builders.

- Decision Automation: Leverage 100+ preset rules for advanced decision automation.

- Global AML and Corporate Screening: Access 100k+ global data sources and integrate with corporate registries.

- Real-time Monitoring: Continuously monitor for risks and receive immediate alerts.

- Adverse Media Intelligence: Uncover hidden connections and analyze risk using an adverse media engine.

- Intelligent Document Processing: 99.1% accurate AI-powered document verification.

- Dynamic Risk Scoring: Tailored risk insights by unifying static, behavioral, and profile data.

Use Cases

- Know Your Supplier

- Client Lifecycle Management

- Customer Onboarding

- Perpetual KYC

- Account Opening

- B2B Onboarding

- Compliance Automation

- Fraud Prevention

FAQs

-

What technologies does KYC Hub employ in its solutions?

KYC Hub technology is based on AI and intelligent automation. We use AI extensively to gain insights from internal and external data using NLP and deep learning for entity resolution and network risk detection, as well as transaction pattern recognition to detect fraud and money laundering patterns. We also use RPA and computer vision technologies to automate manual processes, verify IDs and biometrics, and detect identity fraud. -

How does KYC Hub help organizations mitigate the risk of financial crime?

KYC Hub enables organizations to mitigate the risk of financial crime via workflow orchestration, data aggregation, and a risk engine enabling rapid no-code building and deployment of risk detection and automation applications for different use cases. -

What problem does KYC Hub aim to solve in the field of AML compliance?

Every year organizations spend over $200bn for AML compliance, while fines continue to increase. This is because existing solutions don't address the problem - both in terms of poor data quality and lack of adaptability with new risks and regulations. We employ innovation in data science and workflow orchestration to empower firms to automate their financial crime risk management journeys.

Related Queries

Helpful for people in the following professions

KYC Hub Uptime Monitor

Average Uptime

100%

Average Response Time

825.1 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.