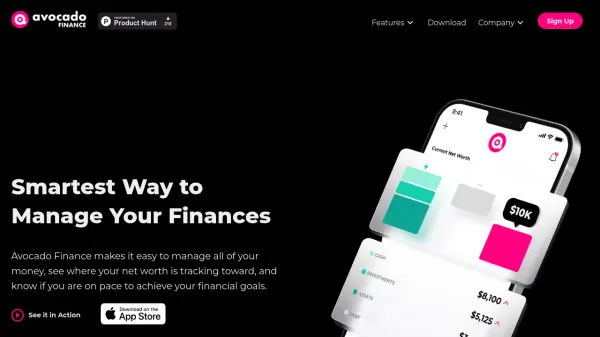

What is Avocado Finance?

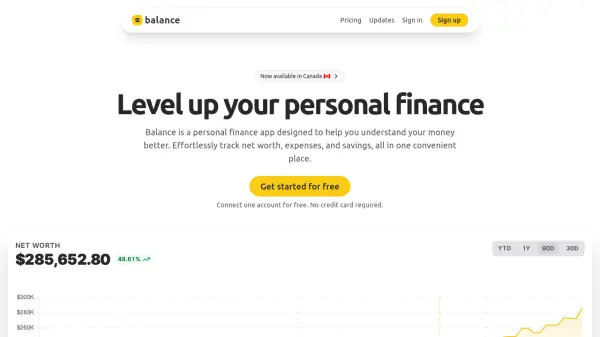

Avocado Finance streamlines personal money management by integrating all your financial accounts into a single, easy-to-use dashboard. Its intelligent system automatically syncs data, providing a real-time overview of your net worth, investments, transactions, and savings plans. The platform delivers personalized financial insights to help users make informed decisions about savings, retirement planning, investments, home purchases, loan refinancing, and emergency funds.

With intuitive features like automated account synchronization and tailored recommendations, Avocado Finance empowers users to plan their financial future, monitor progress towards goals, and make smarter money decisions while keeping their data private and secure.

Features

- Comprehensive Net Worth Tracking: Aggregates and updates all financial assets and liabilities.

- Savings Plan Creation: Builds personalized savings plans for future goals.

- Investment Analysis: Centralizes and analyzes investments for performance tracking.

- Account Synchronization: Connects and syncs multiple financial accounts automatically.

- Transaction Monitoring: Tracks all transactions in a unified interface.

- Retirement Planning: Projects realistic retirement timelines based on user data.

- House Purchase Insights: Assesses purchasing power for home buying decisions.

- Emergency Fund Monitoring: Evaluates the status and adequacy of emergency savings.

- Loan Refinance Checker: Connects loans and identifies potential refinancing opportunities.

- Data Privacy: Ensures user data is private and used solely for insights.

Use Cases

- Tracking net worth and financial growth over time.

- Creating and monitoring a personalized savings plan.

- Analyzing investment portfolios in one place.

- Planning for retirement with realistic projections.

- Assessing readiness and affordability for purchasing a home.

- Monitoring emergency fund adequacy.

- Identifying opportunities to refinance existing loans.

- Automating transaction and account data management for financial clarity.

FAQs

-

How does Avocado Finance ensure the privacy of my financial data?

Avocado Finance does not share your data and uses it only to provide tailored financial insights, maintaining strict privacy and security measures. -

Can I try Avocado Finance before committing to a paid plan?

Yes, Avocado Finance offers a 7-day free trial, allowing users to explore its features before subscribing. -

What types of financial accounts can I connect?

You can connect various financial accounts, including bank accounts, investment portfolios, and loans to get a complete financial overview. -

Does Avocado Finance help with retirement planning?

Yes, the platform provides insights into retirement readiness, including projected age and year for achieving retirement goals.

Related Queries

Helpful for people in the following professions

Avocado Finance Uptime Monitor

Average Uptime

44.96%

Average Response Time

148.63 ms

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.